Is commercial vehicle component maker Accuride Corp. (ACW-$11.25) about to have its wheels flattened by KKR? On November 28, 2006, Accuride Corporation entered into new Change in Control agreements with certain executive officers and other senior management employees, including CEO Terrence J. Keating, President and CFO John R. Murphy, General Counsel David K. Armstrong, Senior VP/ Human Resources Elizabeth I. Hamme, and Senior VP/ Sales & Marketing Henry L. Taylor.

On November 28, 2006, Accuride Corporation entered into new Change in Control agreements with certain executive officers and other senior management employees, including CEO Terrence J. Keating, President and CFO John R. Murphy, General Counsel David K. Armstrong, Senior VP/ Human Resources Elizabeth I. Hamme, and Senior VP/ Sales & Marketing Henry L. Taylor.

In addition, each participating executive is entitled to a Change in Control severance benefit if his or her employment with the Company is terminated during the Protection Period. The change in control severance benefits for the aforementioned executives are equal to 200% -- to -- 300% of the executive’s salary at termination, plus either 200% --to—300% of the greater of the average incentive compensation award over the three years prior to termination.

The 10Q Detective has borne witness recently to instances where Change in Control agreements were [curiously?] executed only weeks—or months—before the publicly traded companies entered into terms of new management.

Accuride is one of the largest manufacturers and suppliers of commercial vehicle components in North America, serving virtually all the heavy-duty and medium-duty OEMs and their related aftermarket channels in most major segments of the commercial vehicle market, including heavy- and medium-duty trucks, commercial trailers, light trucks, buses, as well as specialty and military vehicles (creating a significant barrier to entry).

Its products include commercial vehicle wheels, wheel-end components and assemblies, truck body and chassis parts, seating assemblies and other commercial vehicle components. The Company markets its products under some of the most recognized brand names in the industry, including Accuride, Gunite, Imperial, Bostrom, Fabco and Brillion.

Accuride principally competes in the heavy-duty, or Class 8, truck market, the medium-duty, or Class 5-7, truck market, the commercial trailer market, the light, or Class 3-4, truck market, the bus market, as well as the specialty and military vehicle markets. Heavy- and medium-duty trucks are used for local and long-haul commercial trucking and are classified by gross vehicle weight. The heavy-duty truck market is comprised of trucks with gross weight in excess of 33,000 lbs. and the medium-duty truck market is comprised of trucks with gross weight from 16,001 lbs. to 33,000 lbs.

The Company’s diversified customer base includes substantially all of the leading commercial vehicle OEMs, such as Freightliner Corporation, with its Freightliner, Sterling and Western Star brand trucks, PACCAR, Inc., with its Peterbilt and Kenworth brand trucks, International Truck and Engine Corporation, with its International brand trucks, and Volvo Truck Corporation, or Volvo/Mack, with its Volvo and Mack brand trucks.

Accuride’s core strength is that it the Company holds leading market positions—the number one or number two market position—in most of its major product categories: about an 87% market share in heavy-duty steel wheels, a 48% market share in heavy-duty aluminum wheels, a 55% market share in brake drums, and approximately a 37% market share in disc wheel hubs.

Growth in the commercial vehicle industry tends to grow in-line with the broader economy. As a result, the trucking industry generally correlates with economic indicators, including gross domestic product and industrial production indicators, such as the Industrial Production Index.

The finite lives of commercial vehicles—replacement cycle—is an industry driver, too. Most leading national freight companies replace their vehicles every three to five years. According to America's Commercial Transportation Publications, or ACT, at the end of 2003, the average age of existing heavy-duty truck fleets reached a ten-year high of 5.9 years, relative to the ten-year average of 5.5 years. Historically, vehicle demand increases as trucking fleets revert to a normal age level for their vehicles.

The commercial vehicle market continued at a robust pace during the first nine months of 2006. Freight growth, improved fleet profitability, aging equipment, high equipment utilization, and economic strength continue to drive demand for new vehicles. Current industry forecasts by analysts, including ACT Publications, predict that the North American commercial vehicle industry will continue to be strong throughout 2006, with a decline predicted in 2007 due to a change in emissions standards.

Against this industry backdrop, Accuride surprised Wall Street by posting a 35 percent drop in its 3Q profits. The Company earned $12.4 million, or 36 cents per share, compared with $19.1 million, or 55 cents per share, for the same quarter in 2005. Accuride said that while demand for its products was strong, the company's margins continued to be hurt by higher raw material prices (such as raw steel and aluminum) and other operating costs.

Analysts polled by Thomson Financial had expected a profit of 54 cents per share.

Adjusted EBITDA was $47.9 million for the third quarter of 2006, compared to an adjusted EBITDA of $51.7 million for the same quarter in 2005.

Net sales for the three months ended September 30, 2006 grew 8.1 percent to $341.6 million from $316.1 million in the year-ago period.

The Company—although leveraged—appears to be financially stable. As of September 30, 2006, the Company had cash of $86.7 million. Total debt of $657.7 million and net debt of $571.0 million reflected a net debt reduction of $43.1 million during the quarter (an aggregate amount of $275.0 million in principal amount of 8.5% senior subordinated notes do not mature until 2015).

Accuride is trading on the equity at a gain, with (TTM) ROE of 31.61% outpacing (TTM) ROA of 7.85 percent.

For the third quarter of 2006, cash from operating activities was $50.1 million and capital expenditures totaled $9.5 million, resulting in free cash flow of $40.6 million. Book value stood at about $7.04 per share.

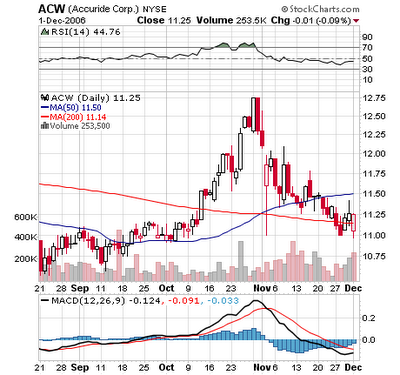

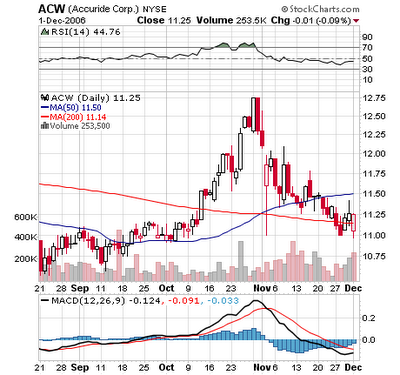

The stock price has fallen about 15.3% in the last year, signaling to us that more than shrinking margins are bothering investors. Accuride is dependent on sales to a small number of major customers: Freightliner, PACCAR, International and Volvo/Mack constituted approximately 52 percent of trailing twelve-month sales. We suggest that replacement demand for heavy-duty trucks—which influences the demand for component sales—is nearing the later stages of a cyclical upturn.

A contracting P/E multiple, too, reveals the deteriorating forward fundamentals of the Company. Consensus estimates for fiscal year ending December 2007 call for share-net of 93 cents (down from EPS of $1.39 just sixty days ago) on sales of 1.10 billion, compared with current year 2006 estimates of $1.82 per share on sales of $1.39 billion.

The stock, with an enterprise value of $959.9 million, is selling at a forward multiple of about 12.10 times 2007 EPS. Comparables are difficult, for example, South African-based Hayes Lemmerz International, Inc. (HAYZ-$2.55), a leading global supplier of automotive, powertrain, suspension, structural and other lightweight components, with an enterprise value of 756.7 million, is projected to lose $2.07 per share (January 2008); whereas, auto-parts maker ArvinMeritor (ARM-$17.32), with an enterprise value of about 2.11 billion, is selling for ONLY 10.8 times forward (September 2008) earnings of $1.67 per share (a 50 cent jump over 2007 EPS).

Back to our original supposition—might a Change in Events be forthcoming at Accuride Corporation?

On April 26, 2005, Accuride completed an initial public offering of its common stock and commenced trading on the New York Stock Exchange. Net proceeds from the initial public offering were $89.6 million (11.0 million shares priced at $9.00 per share).

One of the biggest stakeholders in the Company is one of the world's oldest and most experienced private equity firms specializing in management buyouts—Kohlberg Kravis Roberts & Co? KKR beneficially owns approximately 23% of Accuride’s outstanding shares of common stock and has two partners on the Company’s board of directors. [Full Disclosure -- Pursuant to a management services agreement, KKR renders “management, consulting and financial services” to the Company for an annual fee of $665,000.]

Trimaran Capital Partners, a private asset management firm headquartered in New York (dedicated to leveraged buyouts), with assets under management in excess of $3.8 billion, owns about an 11.4% stake through several entities, too. [Full Disclosure -- Trimaran Fund Management renders “management, consulting and financial services” to the Company for an annual fee of $335,000.]

Avoid being impatient. Remember time brings roses – (Unknown).

KKR, Trimaran Partners, and other institutional investors just might not wait for the roses to bloom come spring.

Editor David J. Phillips holds no financial interest in any of the stocks mentioned in this article. The 10Q Detective has a full disclosure policy.

On November 28, 2006, Accuride Corporation entered into new Change in Control agreements with certain executive officers and other senior management employees, including CEO Terrence J. Keating, President and CFO John R. Murphy, General Counsel David K. Armstrong, Senior VP/ Human Resources Elizabeth I. Hamme, and Senior VP/ Sales & Marketing Henry L. Taylor.

On November 28, 2006, Accuride Corporation entered into new Change in Control agreements with certain executive officers and other senior management employees, including CEO Terrence J. Keating, President and CFO John R. Murphy, General Counsel David K. Armstrong, Senior VP/ Human Resources Elizabeth I. Hamme, and Senior VP/ Sales & Marketing Henry L. Taylor.In addition, each participating executive is entitled to a Change in Control severance benefit if his or her employment with the Company is terminated during the Protection Period. The change in control severance benefits for the aforementioned executives are equal to 200% -- to -- 300% of the executive’s salary at termination, plus either 200% --to—300% of the greater of the average incentive compensation award over the three years prior to termination.

The 10Q Detective has borne witness recently to instances where Change in Control agreements were [curiously?] executed only weeks—or months—before the publicly traded companies entered into terms of new management.

Accuride is one of the largest manufacturers and suppliers of commercial vehicle components in North America, serving virtually all the heavy-duty and medium-duty OEMs and their related aftermarket channels in most major segments of the commercial vehicle market, including heavy- and medium-duty trucks, commercial trailers, light trucks, buses, as well as specialty and military vehicles (creating a significant barrier to entry).

Its products include commercial vehicle wheels, wheel-end components and assemblies, truck body and chassis parts, seating assemblies and other commercial vehicle components. The Company markets its products under some of the most recognized brand names in the industry, including Accuride, Gunite, Imperial, Bostrom, Fabco and Brillion.

Accuride principally competes in the heavy-duty, or Class 8, truck market, the medium-duty, or Class 5-7, truck market, the commercial trailer market, the light, or Class 3-4, truck market, the bus market, as well as the specialty and military vehicle markets. Heavy- and medium-duty trucks are used for local and long-haul commercial trucking and are classified by gross vehicle weight. The heavy-duty truck market is comprised of trucks with gross weight in excess of 33,000 lbs. and the medium-duty truck market is comprised of trucks with gross weight from 16,001 lbs. to 33,000 lbs.

The Company’s diversified customer base includes substantially all of the leading commercial vehicle OEMs, such as Freightliner Corporation, with its Freightliner, Sterling and Western Star brand trucks, PACCAR, Inc., with its Peterbilt and Kenworth brand trucks, International Truck and Engine Corporation, with its International brand trucks, and Volvo Truck Corporation, or Volvo/Mack, with its Volvo and Mack brand trucks.

Accuride’s core strength is that it the Company holds leading market positions—the number one or number two market position—in most of its major product categories: about an 87% market share in heavy-duty steel wheels, a 48% market share in heavy-duty aluminum wheels, a 55% market share in brake drums, and approximately a 37% market share in disc wheel hubs.

Growth in the commercial vehicle industry tends to grow in-line with the broader economy. As a result, the trucking industry generally correlates with economic indicators, including gross domestic product and industrial production indicators, such as the Industrial Production Index.

The finite lives of commercial vehicles—replacement cycle—is an industry driver, too. Most leading national freight companies replace their vehicles every three to five years. According to America's Commercial Transportation Publications, or ACT, at the end of 2003, the average age of existing heavy-duty truck fleets reached a ten-year high of 5.9 years, relative to the ten-year average of 5.5 years. Historically, vehicle demand increases as trucking fleets revert to a normal age level for their vehicles.

The commercial vehicle market continued at a robust pace during the first nine months of 2006. Freight growth, improved fleet profitability, aging equipment, high equipment utilization, and economic strength continue to drive demand for new vehicles. Current industry forecasts by analysts, including ACT Publications, predict that the North American commercial vehicle industry will continue to be strong throughout 2006, with a decline predicted in 2007 due to a change in emissions standards.

Against this industry backdrop, Accuride surprised Wall Street by posting a 35 percent drop in its 3Q profits. The Company earned $12.4 million, or 36 cents per share, compared with $19.1 million, or 55 cents per share, for the same quarter in 2005. Accuride said that while demand for its products was strong, the company's margins continued to be hurt by higher raw material prices (such as raw steel and aluminum) and other operating costs.

Analysts polled by Thomson Financial had expected a profit of 54 cents per share.

Adjusted EBITDA was $47.9 million for the third quarter of 2006, compared to an adjusted EBITDA of $51.7 million for the same quarter in 2005.

Net sales for the three months ended September 30, 2006 grew 8.1 percent to $341.6 million from $316.1 million in the year-ago period.

The Company—although leveraged—appears to be financially stable. As of September 30, 2006, the Company had cash of $86.7 million. Total debt of $657.7 million and net debt of $571.0 million reflected a net debt reduction of $43.1 million during the quarter (an aggregate amount of $275.0 million in principal amount of 8.5% senior subordinated notes do not mature until 2015).

Accuride is trading on the equity at a gain, with (TTM) ROE of 31.61% outpacing (TTM) ROA of 7.85 percent.

For the third quarter of 2006, cash from operating activities was $50.1 million and capital expenditures totaled $9.5 million, resulting in free cash flow of $40.6 million. Book value stood at about $7.04 per share.

The stock price has fallen about 15.3% in the last year, signaling to us that more than shrinking margins are bothering investors. Accuride is dependent on sales to a small number of major customers: Freightliner, PACCAR, International and Volvo/Mack constituted approximately 52 percent of trailing twelve-month sales. We suggest that replacement demand for heavy-duty trucks—which influences the demand for component sales—is nearing the later stages of a cyclical upturn.

A contracting P/E multiple, too, reveals the deteriorating forward fundamentals of the Company. Consensus estimates for fiscal year ending December 2007 call for share-net of 93 cents (down from EPS of $1.39 just sixty days ago) on sales of 1.10 billion, compared with current year 2006 estimates of $1.82 per share on sales of $1.39 billion.

The stock, with an enterprise value of $959.9 million, is selling at a forward multiple of about 12.10 times 2007 EPS. Comparables are difficult, for example, South African-based Hayes Lemmerz International, Inc. (HAYZ-$2.55), a leading global supplier of automotive, powertrain, suspension, structural and other lightweight components, with an enterprise value of 756.7 million, is projected to lose $2.07 per share (January 2008); whereas, auto-parts maker ArvinMeritor (ARM-$17.32), with an enterprise value of about 2.11 billion, is selling for ONLY 10.8 times forward (September 2008) earnings of $1.67 per share (a 50 cent jump over 2007 EPS).

Back to our original supposition—might a Change in Events be forthcoming at Accuride Corporation?

On April 26, 2005, Accuride completed an initial public offering of its common stock and commenced trading on the New York Stock Exchange. Net proceeds from the initial public offering were $89.6 million (11.0 million shares priced at $9.00 per share).

One of the biggest stakeholders in the Company is one of the world's oldest and most experienced private equity firms specializing in management buyouts—Kohlberg Kravis Roberts & Co? KKR beneficially owns approximately 23% of Accuride’s outstanding shares of common stock and has two partners on the Company’s board of directors. [Full Disclosure -- Pursuant to a management services agreement, KKR renders “management, consulting and financial services” to the Company for an annual fee of $665,000.]

Trimaran Capital Partners, a private asset management firm headquartered in New York (dedicated to leveraged buyouts), with assets under management in excess of $3.8 billion, owns about an 11.4% stake through several entities, too. [Full Disclosure -- Trimaran Fund Management renders “management, consulting and financial services” to the Company for an annual fee of $335,000.]

Avoid being impatient. Remember time brings roses – (Unknown).

KKR, Trimaran Partners, and other institutional investors just might not wait for the roses to bloom come spring.

Editor David J. Phillips holds no financial interest in any of the stocks mentioned in this article. The 10Q Detective has a full disclosure policy.

2 comments:

Hell of a call you made on Force Protection. Keep up the great bloggin!!

I am amazed at the viscious ad hominem & 'anonymous' e-mails that continue to litter my blog on my contrary opinion held on Force Protection. FOR THE LAST TIME -- I AM NOT IN LEAGUE WITH SHORT-SELLERS & OSAMA BIN LADEN; nor have I ever held a short-position in FRPT.

I AM HAPPY FOR ALL THOSE WHO ARE MAKING MONEY BY BEING LONG FRPT.

MY ANALYSIS ON FRPT WAS BASED ON A SET OF PREMISES: EG --"MATERIAL IMPACT ON FUTURE EPS CAUSED BY POTENTIAL CAPACITY CONSTRAINTS"-- I APPLAUD FRPT MNGT FOR BEING INNOVATIVE & NEGOTIATING SUBCONTRACT DEALS W. OTHER DEFENSE MANUFACTURERS TO HANDLE OVERFLOW CAPACITY ISSUES.

Seriously, though, to all you 'gloating' -- and you know who you are....I AM THRILLED THAT YOU MADE MONEY :).

But if all you heard were [paid for] positives on FRPT -- how could you possibly make a comprehensive & educated investment decision?

Please pass this message on to all your loyalists at Raging Bull and all the other FRPT haunts -- oh, by the way, I have posted on more than 100 other companies in the last 12 -months.

Why is it that I never hear from you all about the dozens & dozens of winning ideas presented on my site?

Thank you for the negative comments -- "tis better to be talked about than never talked about at all!"

God Bless!

David J. Phillips, Publisher

www.10qdetective.blogspot.com

Post a Comment