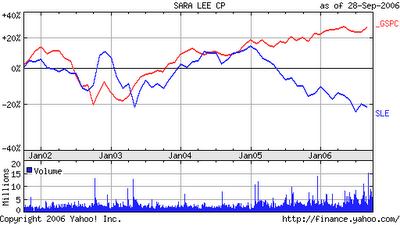

GSPC = S&P 500 Index

----------------------------------------------------------------

Last week, food & consumer products maker Sara Lee (SLE-$16.03) filed its Proxy Statement with the SEC. Of interest, the 10Q Detective noted that for the FY ended July 1, 2006, the top five executives earned (on average) $1.0 million in performance-based cash bonuses.

Brenda Barnes, Chairman & CEO, took home more than $2.1 million in salary and bonus, 950,000 stock options, and $1.7 million in restricted stock awards. In 2005, she received $1,308,725 in salary and bonus, 250,000 options, and restricted stock awards valued at $5,065,038.

The price of the Common Stock of Sara Lee has slumped 15.05% in the last 52-weeks, (reflecting investor skepticism with inconsistent quarterly growth and profits and uncertainty regarding the timing of a “promised” turnaround due to restructuring efforts by management). In the comparable period, the S&P 500 Index gained 9.06% in value.

The American Federation of State, County and Municipal Employees, a large labor union which beneficially controls 8,424 Sara Lee shares, has submitted a proposal (to be voted on by shareholders at the Annual Meeting on Thursday, October 26, 2006), asking the Board of Directors to adopt a policy that would allow stockholders to express their opinion about senior executive compensation practices by establishing an annual referendum process.

The union believes that the results of such a vote would provide Sara Lee with useful information about whether stockholders view the company’s compensation practices, as reported each year in the Compensation Discussion and Analysis, to be in stockholders’ best interests: “We believe that the current rules governing senior executive compensation do not give stockholders enough influence over pay practices… Stockholders do not have any mechanism for providing ongoing input on the application of standards to individual pay packages.”

Would it surprise any of our readers to hear that the Company has recommended to stockholders to vote against the union proposal, countering that Sara Lee already has an efficient and meaningful method for stockholders to communicate their concerns with the Board. [Ed. note. They can write letters!]

Management has been divesting non-core operations, such as luxury goods (Coach leather goods—April 2001), European meats division (Summer—2006), and branded U.S apparel units (e.g. Hanesbrands Inc. IPO—September 2006).

Additionally, in August 2006, the Company cut the annual dividend almost 50% (from 79 cents to 40 cents per annum).

For all these efforts, consensus estimates call for share-net to come in around $0.81 cents and $0.85 cents, respectively, in FY 2007 and FY 2008—well below 2005 EPS of 92 cents.

According to Sara Lee’s Committee, the executive compensation program is designed to “retain key executives” and to support the practice of appropriately rewarding key executives for positive results (i.e. profitable growth and increased stockholder value).

In this case, recompense as a loyalty incentive is not necessary—the 10Q Detective says let the “key executives” walk out the door. As for excuse number two—rewarding the key executives for performance—the empirical evidence suggests that the Committee is doing a disservice to all stakeholders—what performance?

The 10Q Detective does not wish to be a doubting Thomas, but we would not bet the farm on Proposal No. Four getting a yeah vote.

No comments:

Post a Comment