Companies in the besieged orthopedic device maker space, like Biomet (BMET-$32.68), Stryker Corp. (SYK-$47.38), and Zimmer Holdings (ZMH-$67.83), the largest (independent) orthopedic player, whose stock prices have slumped 12.5%, 11.1%, and 17.51%, respectively, in the past year, recently caught a break. After initially signaling to manufacturers that reimbursements would stay flat next year, on August 1, 2006, the Centers for Medicare and Medicaid Services (CMS) announced its decision to raise payments for joint-replacement surgeries by 4%-to-5% in FY 2007. According to industry analysts, this rate relief should give the companies more pricing flexibility with their product mixes.

Companies in the besieged orthopedic device maker space, like Biomet (BMET-$32.68), Stryker Corp. (SYK-$47.38), and Zimmer Holdings (ZMH-$67.83), the largest (independent) orthopedic player, whose stock prices have slumped 12.5%, 11.1%, and 17.51%, respectively, in the past year, recently caught a break. After initially signaling to manufacturers that reimbursements would stay flat next year, on August 1, 2006, the Centers for Medicare and Medicaid Services (CMS) announced its decision to raise payments for joint-replacement surgeries by 4%-to-5% in FY 2007. According to industry analysts, this rate relief should give the companies more pricing flexibility with their product mixes.Nonetheless, after reviewing recent SEC filings, the 10Q Detective believes that Biomet will under perform its peers. Simply, despite changes in senior management and other restructuring moves, the Company’s financial performance in recent quarters has failed to show any meaningful improvement in margin gains—and is probably months away from materializing (if at all).

Hip and knee and extremity joint replacements account for more than 95% of all orthopedic implants and Biomet holds about 12% of this market, which accounted for 68% of the company's net sales in FY 2006.

Biomet, with operations in 60 locations and distributions in more than 100 countries, operates in three other musculoskeletal market segments, too. (1) Fixation devices, which represented 12% of the Company's net sales for fiscal year 2006, include internal (products such as nails, plates, screws, pins and wires designed to stabilize traumatic bone injuries) and external fixation devices (utilized for stabilization of fractures when alternative methods of fixation are not suitable), craniomaxillofacial fixation systems and electrical stimulation devices that do not address the spine. (2) Spinal products, which represented 11% of the Company's net sales for fiscal year 2006, include electrical stimulation devices addressing the spine, spinal fixation systems and orthobiologics. (3) The other product sales category, which represented 9% of the Company's net sales for fiscal year 2006, includes arthroscopy products, softgoods and bracing products, casting materials, general surgical instruments, operating room supplies and other surgical products.

Net sales increased 8% during the current fiscal year ended May 31, 2006, to $2.02 billion from $1.87 billion in 2005.

In the reconstructive device space, worldwide sales increased 10% to $1.38 billion in fiscal 2006. Factors contributing to this increase included: 14% sales increase in dental reconstructive products, a 9% increase in hip replacement sales, offset by bone cement and accessory sales decreases of 5 percent. Bone cement and accessory sales were negatively impacted by the loss of the Company's primary bone cement supplier during the year. The Company introduced its own bone cement during the year and anticipates recapturing some of its lost market share.

The knee replacement market saw healthy growth, too, with sales increasing 12% worldwide. These percentages were partially achieved by continued acceptance of Biomet’s Vanguard Complete Knee System and the domestic Oxford Unicompartmental Knee System, the only free-floating meniscal unicompartmental knee system available in the United States.

The aforementioned CMS price allowance for FY 2007 is of material significance, for worldwide product volume growth in the hip & knee reconstructive market is expected to be approximately 7% -to- 9% per annum in the coming years—which means Biomet can only show double-digit growth by product/volume mix increases (new product rollouts and/or price increases of legacy products) and/or by cannibalizing market share from other (formidable) competitors.

Fixation sales increased 2% during fiscal 2006 to $251.36 million.

Craniomaxillofacial products, including bone substitutes, increased 12%; internal fixation devices increased 6%, offset by sales declines in electrical stimulation devices.

Favorable pricing and incremental volume/product mix increases of spinal hardware, including orthobiologics (like the Osteoprogenitor-Bone Marrow Aspiration Kit & the Demineralized Bone Matrix), offset by spinal stimulation product sales declines, lead to a 4% increase in spinal sales to $221.9 million in FY 2006.

Sales of the Company's other products increased 5% to approximately $173.0 million in fiscal 2006. Favorable pricing and incremental volume/product mix increases of arthroscopy products and general surgical instrumentation goods contributed to these gains.

Net Income grew to $496.14 million for FY 2006 from $351.62 million in 2005. However, this result was magnified by a 250 basis point decrease in the Company’s effective tax rate and a reduction in the shares used in the computation of earnings per share (through a share repurchase program), which resulted in an 18% increase in basic earnings per share for 2006 to $1.64 compared to $1.39 in 2005.

Management admits to unresolved problems endemic to the Company that could shadow future financial performance. The fourth quarter had a 5% decrease in net profit, in part because SG&A expenses increased 1% to $190.5 million, representing 35.3% of sales (management turnover and related severance packages) and continued sales shortfalls—despite a reorganization—of its spinal and fixation market(s) subsidiary, EBI.

To improve EPS visibility going forward, corporate announced several ongoing initiatives on its fourth quarter sales call:

- Reduce COGS. The Company is looking to identify and reduce excess capacity by consolidating its worldwide manufacturing operations (e.g. Biomet has initiated a program to bring all of its spinal manufacturing in house). Additionally, management has announced plans to no longer outsource production of bone-cement (its former dependency on one outside supplier led to lower profit margins on bone-cement products when the Company [Heraeus Kulzer GmbH] raised its prices at the end of FY 2005).

- Reduce SG&A. Given a plethora of acquisitions over its twenty-seven year history, decentralization formerly had served the Company well in fermenting an entrepreneurial spirit. However, with SG&A eating up more than 35 cents in every dollar of sales in the fourth quarter, management intends to become more centrally focused in key operational areas such as accounting, IT, human resources, regulatory and clinical affairs plans. [Ed note. Look for headcount reductions.]

- Corrective actions taken at EBI include the announced resignation of, Bart Doedens, M.D., less than one year after being promoted to the position. [Ed. note: Dr. Dane Miller, co-founder and former CEO said about Doedens on June 30, 2005: “We are confident that Dr. Doedens will provide the leadership capabilities necessary to position EBI as a leader in the spinal and fixation market places."]

- New Product Rollouts. In the past six fiscal years, Biomet has introduced more than 700 new products to the market. Continuing this product launch streak, the Company is hoping that the following systems will be big revenue drivers in the coming quarters:

- Vanguard Complete Knee System is designed to provide precise fit for all patients regardless of gender, race, stature or any other variables contributing to anatomical differences. According to corporate, the Vanguard is the most comprehensive total knee system on the market today, offering full interchangeability of the system’s components, and providing greater bone preservation than competitive high flex systems. In FY ’06, the Company continued the development efforts to complete the rotating platform and revision options of its Knee System, rolling out the Vanguard Interior Stabilized Bearings during the 4Q:06, and the Company also received regulatory clearance for the Vanguard Pop Top Tibia.

- Oxford Unicompartmental Knee System is the only free-floating meniscal-bearing Unit available in the U.S. According to Biomet, more than 100 U.S. surgeons completed Oxford training in the 4Q:06.

- Hip Systems. Biomet continues to explore the development of innovative articulation technologies and materials. The Company received FDA clearance during the fourth quarter for Acetabular cups manufactured with Biomet's Regenerex core titanium construct. Titanium has become a clinically proven material in the orthopedic market, resulting in optimal biological fixation. Management believes the long-term success of Biomet's titanium implants will translate into strong demand for Regenerex as the material of choice for porous metal constructs (and complement the Company’s best-selling M2a-Magnum Acetabular systems). Corporate is scheduled to initiate the launch of Regenerex cups and augments during the second quarter of fiscal 2007.

- In Europe, the Recap Total Resurfacing System is experiencing strong market acceptance. The Recap is a bone conserving resurfacing system indicated for patients in the early stages of degenerative joint disease. During the fourth quarter, the Company introduced the Recap Ha, Hydroxy Appetite Coated Shell to the European market. In the U.S., Biomet continues to enroll patients in its IDE study for the Recap Total Resurfacing System, which currently has approximately 50 patients enrolled.

- On the spine side, the Polaris Synergy System is expected be a big driver as Biomet progresses through fiscal 2007. Internal fixation products like locking plates and [inaudible] screws are viewed as critical to a sales ‘turnaround' at EBI in FY ’07.

- Extremity Systems. The recently introduced ExploR Radial Head Replacement continues to receive excellent market acceptance. The ExploR, a two-piece hemi-elbow, modular device, includes a tapered stem and a head designed to articulate with the patient’s natural bone.

- Maestro Wrist, which was also introduced recently, can be used as a total wrist device or a hemi arthroplasty for carpal replacement.

- Biomet is looking to ‘stimulate’ growth' at its troubled EBI unit with the introduction of several new electrical stimulating bone growth products.

As a percent of sales, research and development expenses were 4.2% in fiscal 2006 and 2005.

Demographics support future growth trends in the musculoskeletal market space. According to U.S. Census Bureau projections, the 55 –to- 75 year-old U.S. population is expected to almost double in the coming decade (from 39.6 million in 2006 to 68.0 million in 2016). And this healthier, aging boomer generation is demanding top quality care to stay active.

Today’s surgeons are driving trends as well, since they are more willing to grant surgery with the knowledge that newer technology is bringing with it pain relief and longer-lasting materials.

The Company believes it has firmly positioned itself as a surgeon advocate and has worked to promote the right of the surgeon to prescribe the medical treatment best suited to the needs of the individual patient.

Biomet was the first company to introduce (muscle sparing) microplasty minimally invasive totally knee replacement system. In the last three years, more than 1,350 surgeons completed instrument training. During FY ’06, the Company continued its expansion of the Microplasty Minimally Invasive Instrument Platform to include less invasive posterior referencing, anterior referencing and image-guided options.

Valuation Analysis

As mentioned earlier, CMS announced the revised reimbursement rates that will go into effect October 1, 2006. Biomet believes (as do we) that this action reflects a positive pricing environment for the majority of the Company’s products. The new reimbursement rates for Major Joint Replacement and Hip or Knee Replacement will reflect an increase of 4.2% and 5.0%, respectively. As a group, the new reimbursement rates for spinal and trauma procedures are estimated to increase an average of 7.0 percent—all fundamental positives for the Company.

Biomet is in the midst of several major product launches and management anticipates that the Company will continue to be rolling out instruments at least early into fiscal 2007.

Looking ahead, Biomet said it remains "comfortable" with analysts' sales and earnings estimates of $513 million to $530 million and 43 cents to 45 cents per share for the first quarter of fiscal 2007, and $2.15 billion to $2.22 billion and $1.85 to $1.95 per share for fiscal 2007.

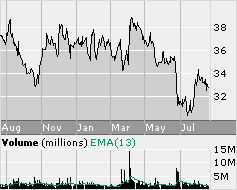

The Company’s valuation looks attractive. The Common Stock’s valuations are priced at multi-year lows. For example, BMET’s P/E is only 17.5 times forward May 2007 consensus estimates of $1.87 per share [low end]. This is a 38.5% discount to its trailing five-year mean multiple of 28.5 times earnings. And with an estimated forward five-year EPS growth rate of 15.0%, the Company’s PEG multiple is an attractive 1.2 times [in line with its peer group multiple, which includes Stryker Corp., Zimmer Holdings, and Smith & Nephew].

Value investors might also note the predictable 30% operating margins, and the 20.4% return on capital (compared to its cost of capital of 5.8%).

Tempering these valuations, however, is the boring—in your face—thesis that there are few catalysts on the event horizon to expand valuation multiples (such as a turnaround in its EBI operations or margin improvement gains).

Patient investors with a longer-term view might consider the current price as an entry point, but (with a dividend yield of 0.90%) we prefer to put our dollars to work elsewhere.

In April 2006, the Company confirmed that it hired investment banker Morgan Stanley to help explore future strategies, including a possible move to put itself up for sale. Analysts have cited Medtronic and Smith & Nephew as potential buyers. The asking price for Biomet, should it decide to sell, could be more than $10 billion—or approximately $44.40 per share.

Investment Risks & Considerations

Litigation. Biomet is not without obstacles on the road to sustainable profitability. In June, the US Justice Department, which is investigating various companies for possible antitrust violations, subpoenaed the Company.

Additionally, in March 2005, the U.S. Attorney’s Office subpoenaed Biomet for documents related to consulting and other agreements with surgeons (using or considering the use of Biomet’s hip or knee implants).

Foreign Currency Exposure. During fiscal year 2006, sales of the Company’s products in foreign markets approximated $700.6 million, or 35%, of total revenues. Ergo, significant increases in the value of the U.S. dollar relative to foreign currencies could have an adverse effect on the Company’s results of operations.

Corporate Governance Issues

On July 12, 2006, Biomet announced the resignation of Bart J. Doedens, M.D., the erstwhile President of EBI, who left “to pursue other interests.” In our view, Doedens—who headed up EBI for only one-year—did not leave voluntarily; he was “fired.” Articulating such language, however, might have jeopardized the $720,000 bonus previously paid to Mr. Doedens for relocation expenses [when he was promoted in 2005].

On May 8, 2006, the Company entered into a Separation, Release and Consultancy Agreement with Dane A. Miller, PhD, 60, a cofounder and former CEO of Biomet. Dr. Miller will receive $9 million in connection with the separation package. Pursuant to the terms of the Separation Agreement, Dr. Miller will receive $4,000,000 on October 1, 2006, $500,000 on November 30, 2006 and $500,000 on the last day of each quarter thereafter through the first quarter of fiscal year 2010, as compensation for “consulting services” to be provided in accordance with the terms of the Separation Agreement.

The 10Q Detective shucked these other pearls from Dr. Miller’s Consultancy Agreement, too:

In the event of Miller’s incapacity or death, his estate or heirs shall receive from the Company the balance due on the contract. [Ed note. How can one do consulting if they are dead?]

Biomet shall also reimburse Miller up to $100,000, paid monthly, per fiscal year, for the out-of-pocket fees and expenses of the services of a secretary and the provision of an office (not in the Company's facilities).

On behalf of the Company in his capacity as a consultant, his foregoing duties shall not exceed forty hours per month (or twenty hours per week).

After the Termination Date, Miller shall be compensated by the Company at the rate of $500 per hour plus expenses for additional ‘consulting duties.’

And, yes, he gets to keep his laptop and company car.

Dane Miller beneficially owns 6.02 million shares, or 2.5%, of the Common Stock of Biomet, worth an estimated $196 million.

Dr. Miller is also the majority shareholder in a corporation, AirWarsaw, Inc., which provided the use of an aircraft to Biomet on an as-needed basis through May 31, 2006. Biomet paid a flat monthly fee of $39,750, plus sales tax, to AirWarsaw for the use of the aircraft. During the last fiscal year, Biomet made payments to AirWarsaw of approximately $505,620 in rental fees. This lease was terminated effective May 31, 2006. The Company does not expect to make any payments to AirWarsaw during fiscal year 2007.

In addition, during fiscal year 2006, Biomet purchased a motor home, at a cost of $349,381 to be used to transport people for tours and other Company business. This motor home was purchased from ForeTravel Motorcoach, a company in which Dr. Miller was a minority shareholder and a member of the board of directors.

On August 15, 2006, management filed their annual Proxy Statement with the SEC. Buried in one of the back pages we found this gem: “The Committee believes that the executive compensation programs and practices described above are conservative and fair to Biomet’s shareholders. The Committee further believes that these programs and practices serve the best interests of Biomet and its shareholders.”

“The more things change, the more they remain…insane.” --Michael Fry & T. Lewis (Over the Hedge comic strip)

1 comment:

Thanks a lot for sharing. You have done a brilliant job. Your article is truly relevant to my study at this moment, and I am really happy I discovered your website. However, I

would like to see more details about this topic. I'm going to keep coming back here.

Ophthalmology

Post a Comment